For decades, the world's Gin market was split between a few major players. Classic Gin brands like Gordon's, Tanqueray, and Beefeater made up for the vast majority of Gin consumption.

In recent decades, however, more and more brands have entered the market. In 1987 it was Bombay. In the early 2000s came Hendrick's Gin, and since 2008 countless craft Gin producers have followed suit. Today, the selection is larger and more diverse than ever before.

These developments not only lead to more choices but also to massive growth. Especially in the market of premium Gin, the numbers are astonishing. So let's look at today's Gin market.

The Global Gin Market in the Last Decade

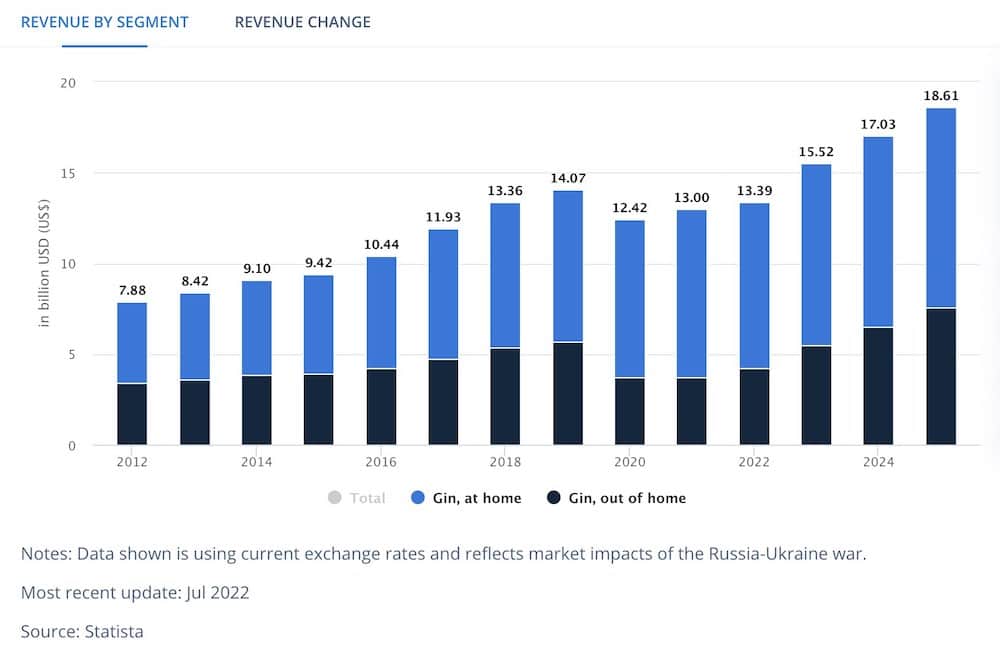

According to data from Statista, the revenue of the global Gin market rose from $7.88 Billion in 2012 to $14.07 in 2019. That's a massive increase - almost double within a period of seven years.

In 2020, the overall revenue dropped to $12.42 Billion due to Covid-19. However, this is only related to out-of-home consumption because restaurants and bars everywhere were closed for a long time. The "At home" consumption grew from $8.4 Billion in 2019 to $8.7 in 2020.

For the next three years, from 2023 to 2025, the expected annual growth is projected at 9,47%. That could lead to a sensational $18.61 Billion in 2025 ($11.02 at home, $7.59 out of home).

Leading Countries in the Gin Market

Based on revenue, the UK is the leading country when it comes to Gin, which is not a tremendous surprise. The following countries, though, especially their order might be less evident (data from 2022):

- United Kingdom - $4.3 Billion

- United States - $2.9 Billion

- India - $1.8 Billion

- Spain - $0.9 Billion

- Germany - $0.8 Billion

| Market | Revenue in 2023 | Annual growth until 2025 | Avg. Consumption per person | Avg. Revenue per person |

|---|---|---|---|---|

| United Kingdom | $4.27 billion | 13.57% | 1.18L | $62.05 |

| United States | $2.88 billion | 7.90% | 0.18L | $8.55 |

| India | $1.83 billion | 6.20% | 0.3L | $1.29 |

| Spain | $0.91 billion | 3.75% | 0.63L | $19.57 |

| Germany | $0.8 billion | 10.01% | 0.32L | $9.55 |

United Kingdom

With almost $4.3 Billion, the Gin market in the UK is number one, and there seems no end in sight. On the contrary, the forecasted growth for the next three years is at 13.57%, which is way above the industry average.

But not only does the UK generate the most revenue, but they're also the worldwide leader in exporting Gin. In 2021, the UK exported Gin worth just shy of $750 million. The second-strongest exporter (Germany) only exported products valued at $95 million.

The average consumption per person and also the average revenue per person are significantly higher than in any other of the top Gin markets. Compared to the US, the average consumption is roughly six times higher.

United States

At $2.88 Billion, the US still has the second-largest Gin market in the world. However, the forecasted growth for the next few years is below the industry average. Also, the average volume per capita is on a decline.

In 2020, the Gin market dropped significantly due to restrictions caused by Covid-19. Until 2022, the market didn't fully recover but is expected to do so in 2023. In 2025, the projected revenue is $3.35 Billion.

India

Gin has long been a popular spirit in India. Especially in combinations like a Gin and Tonic. Strong economic growth and increased wealth in the country also helped liquor demand to rise to new heights.

Between 2012 and 2017, the revenue generated by Gin in India more than tripled. In 2023, the revenue is estimated at $1.83 Billion, and for the years beyond, the predicted annual growth rate is 6.20%.

Along with revenue, the average consumption per person and the price per serving increase steadily. The volume per person is expected to hit 0.3l per person.

Spain

Spain has a strong tradition of consuming the herbal spirit. Yet, among the top 5 leading Gin markets, it's the only country that doesn't show steady growth. Instead, the development of revenue is quite volatile. For 2023, the projected revenue numbers are at $0.91 billion.

Until 2025 there's an expected annual growth of 3.75%. This does not correlate with Gin consumption which peaked in 2015 and has been declining since then. Instead, the increased revenue is generated by higher prices. In 2015 the cost per serving of Gin was at its lowest point in the past decade.

Germany

Germany plays a vital role in the world of Gin. The most renowned German brand, Monkey 47 Schwarzwald Dry Gin, is one of the main reasons why the Gin hype started there, and the producer from the black forest is also the main driver for Gin exports.

In 2023, the revenue will almost hit $0.8 billion, with an expected annual growth of 10% until 2025. That's not enough to overtake Spain but will further close the gap between both countries.

World Gin Consumption

The global Gin consumption is expected to reach more than 900 million liters. By then, the market is forecast to grow at a rate of 3.8% per year.

WANN ERREICHT ER 900 MIO? 2023?

In the shadows of the most profitable Gin markets, there's a surprising world leader when it comes to Gin consumption. According to IWSR data, the country which consumes the most Gin in the world is the Philippines.

A major driver behind this enormous number is San Miguel Gin, a cheap and locally produced spirit, accounting for 17% of the worldwide Gin consumption in 2018. This spirit is so popular due to its low price point: one 0.7L bottle sells for around $2.

While the Gin experiences a general upswing, it's the premium products that really drive the success. The premium, super-premium, and ultra-premium segments outperform the average growth by far.

To put this premiumization into perspective, here is some data: Between 2013 and 2018, the annual growth of ultra-premium was just above 50%. Super-premium Gin still grew at 25.2% annually, and premium Gin at 14.7%.

This development also aligns with what we see in the leading Gin markets, where the average consumption grows slowly, but higher price points per serving drive revenue to new heights.

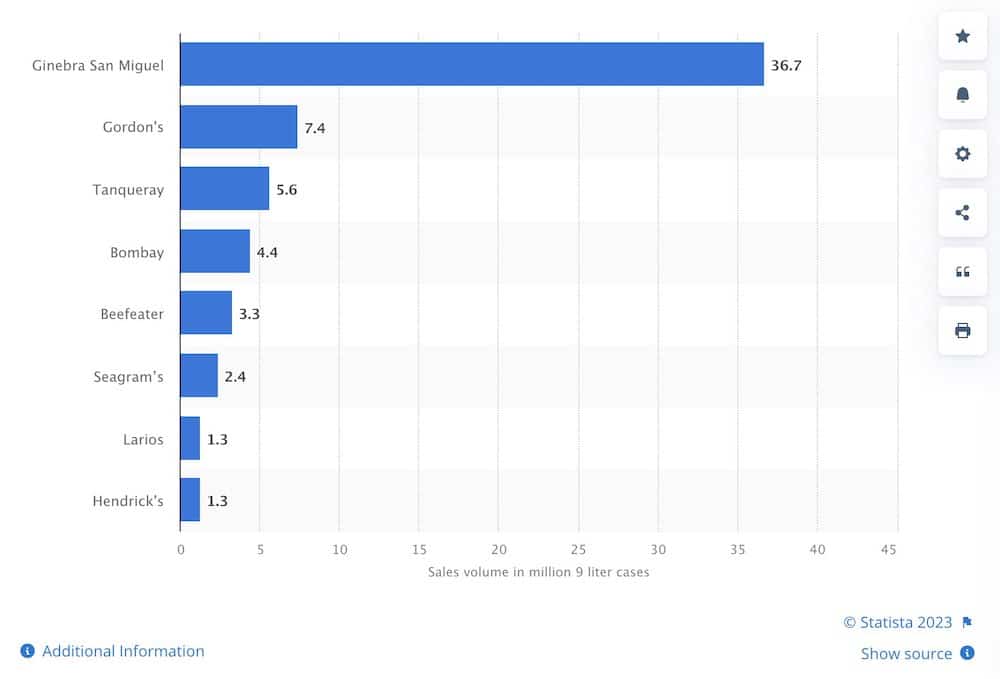

Leading Gin Producers in the world

The currently leading producers are Ginebra San Miguel. According to numbers from Statista, the Philippine brand produces more than Gordon's Gin, Tanqueray, or Bombay Sapphire.

San Miguel sold more than an unbelievable 36.7 million 9-liter cases. The second-placed Gordon's Gin sold 7.4 million 9-liter cases, Tanqueray 5.6 million, and Bombay 4.4 million.